Google is Missing from The Next Tech Order!

How the Coatue Fantastic 40 Signals a Fundamental Shift in Business Discovery and Value Creation

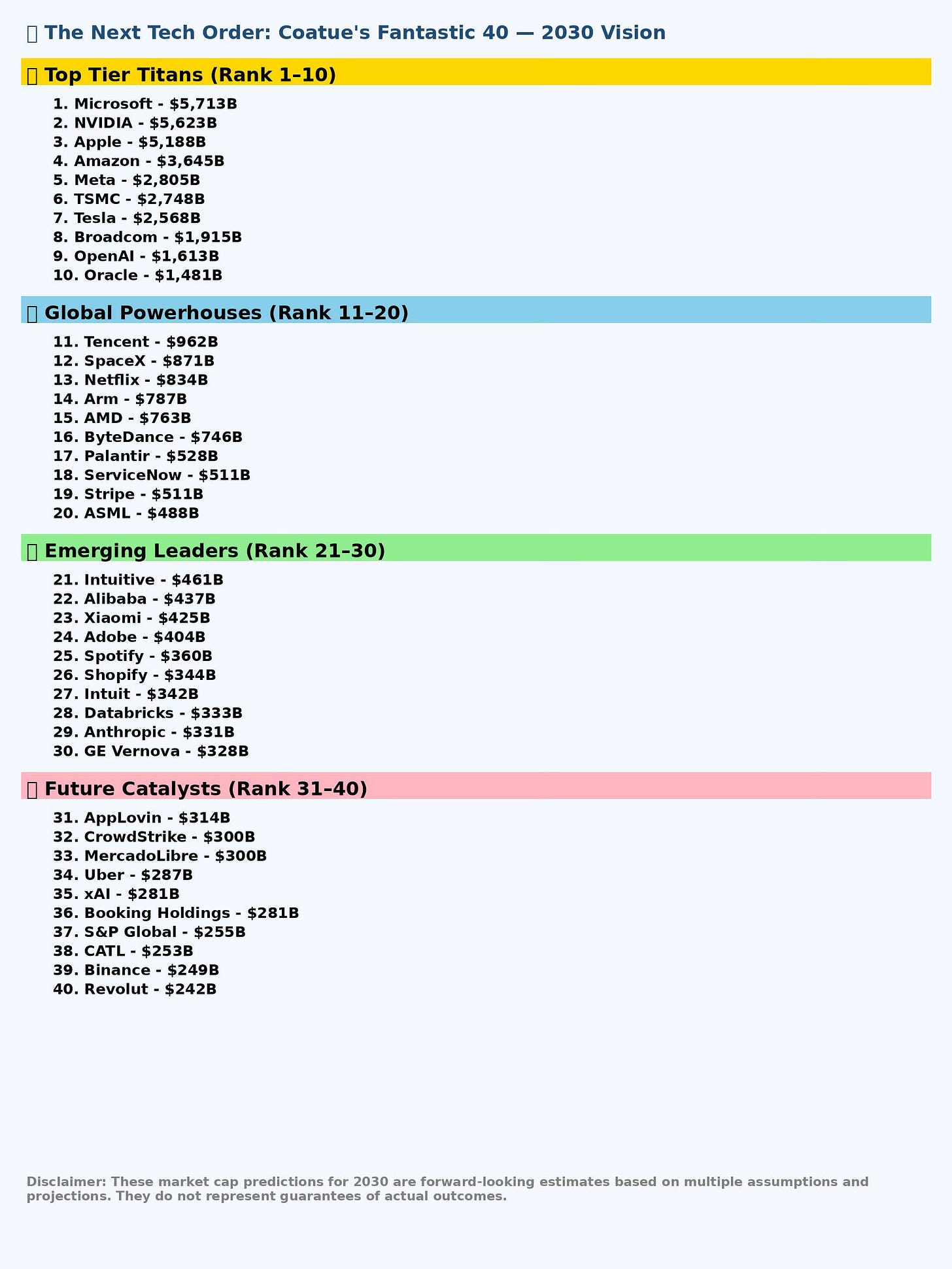

The absence of Google from Coatue Management's prestigious "Fantastic 40" list of projected top market cap companies by 2030 represents more than just an investment prediction. It signals a profound transformation in how digital businesses must approach marketing, advertising, and customer discovery in an AI-dominated future. This shift demands that marketers, digital business leaders, and entrepreneurs completely reimagine their fundamental strategies for reaching and engaging customers.

The Visionary Force Behind the Prediction: Coatue's East Meets West Conference

Philippe Laffont and the Genesis of Technological Foresight

Philippe Laffont, founder of Coatue Management, has established himself as one of the most prescient voices in technology investing. After graduating from MIT in 1991 with degrees in both Economics and Computer Science, Laffont's unique combination of technical understanding and financial acumen positioned him perfectly to navigate the technology landscape. After working as a McKinsey consultant and later as a research analyst at Julian Robertson's legendary Tiger Management, Laffont founded Coatue in 1999 with just $45 million in capital.

Today, Coatue manages over $54 billion in assets under management and has become one of the most influential voices in technology investing. The firm's portfolio includes transformative companies like ByteDance, Databricks and Spotify, demonstrating Laffont's ability to identify and invest in companies that reshape entire industries.

The East Meets West Conference: A Decade of Technological Dialogue

Since 2015, Coatue has hosted its annual East Meets West conference, bringing together technology leaders and visionaries from across the globe for strategic discussions about innovation and market evolution. This conference has become a premier venue for understanding the intersection of technology, capital, and market dynamics. The event's significance extends beyond networking, it serves as a platform where Coatue shares its most important market insights and predictions, including the highly influential "Coatue View on the State of the Markets" presentation.

The 2025 conference presentation, which unveiled the Fantastic 40 list, represents Coatue's most ambitious prediction yet: a projection of the companies that will dominate global markets by 2030 based on their deep conviction about artificial intelligence, technological infrastructure, and changing consumer behaviours.

Decoding the DNA of Future Value: What Makes the Coatue Fantastic 40 Special

The Architecture of Tomorrow's Dominant Companies

The Coatue Fantastic 40 reveals a clear pattern in what constitutes valuable companies in the AI era. These organizations share several critical characteristics that distinguish them from traditional technology giants:

AI-Native Infrastructure and Capabilities: Companies like Microsoft ($5.7 trillion projected market cap), NVIDIA ($5.6 trillion), and OpenAI ($1.6 trillion) represent the foundational layer of the AI economy. These companies have either built their entire business models around AI or have successfully transformed their operations to become AI-first organizations.

Platform Economics and Network Effects: The list heavily favours companies that create platforms rather than just products. Amazon ($3.6 trillion), Meta ($2.8 trillion), and ByteDance ($746 billion) all demonstrate the power of network effects, where value increases exponentially as more users join their platforms.

Data Advantage and Processing Power: The most valuable companies of 2030 will be those that can collect, process, and monetize data at unprecedented scales. TSMC ($2.7 trillion) and Broadcom ($1.9 trillion) represent the hardware infrastructure that makes this data processing possible.

Vertical Integration and Control: Unlike the previous era where specialization was key, future winners demonstrate remarkable vertical integration. Tesla ($2.6 trillion) controls everything from battery technology to autonomous driving software, while companies like Stripe ($511 billion) have built comprehensive financial infrastructure stacks.

The New Value Creation Paradigm

What distinguishes these companies from traditional technology leaders is their approach to value creation. They don't just participate in existing markets, they create entirely new categories of value. OpenAI, for instance, didn't just build a better search engine; it created an entirely new way for humans to interact with information. Similarly, companies like Databricks ($333 billion projected) are building the infrastructure that will power every other company's AI transformation.

This represents a fundamental shift from the previous technology era, where value was often created through optimization and efficiency gains. The Fantastic 40 companies are creating value through paradigm shifts, fundamentally changing how entire industries operate.

The Great Search Disruption: Why Google's Absence Signals a Marketing Revolution

The Structural Decline of Traditional Search

Google's conspicuous absence from the Coatue Fantastic 40 reflects a deeper structural challenge facing the search giant. Despite maintaining approximately 90% market share in traditional search, Google has experienced concerning trends that suggest its dominance may be more fragile than previously assumed. As of January 2025, Google's market share remained under 90% for four consecutive months, the first time this had occurred since 2015.

This decline coincides with fundamental changes in how people discover and consume information. Research indicates that 27% of UK and US users now prefer AI chatbots like ChatGPT over traditional search engines for certain types of queries. This shift represents more than just user preference, it signals a transformation in the fundamental architecture of information discovery.

The Rise of Zero-Click Searches and AI Summarization

The emergence of "zero-click searches" poses an existential threat to Google's advertising-based business model. According to Cloudflare CEO Matthew Prince, 75% of Google searches now end without the user clicking through to the original source. This trend has accelerated with Google's own AI Overviews feature, which provides direct answers at the top of search results pages.

For publishers and content creators, this shift has dramatic implications. Ten years ago, for every two pages scraped by Google, websites would receive one visitor in return. Today, that ratio has deteriorated to six pages scraped for every visitor. For AI-native platforms, the economics are even more challenging: OpenAI reportedly scrapes 250 pages for every visitor sent, while Anthropic's Claude has an astronomical 6,000-to-1 ratio.

The AI Search Ecosystem Takes Shape

The competitive landscape for search is rapidly diversifying beyond traditional players. AI-powered platforms like Perplexity, ChatGPT Search, and Claude are gaining traction by offering conversational, context-aware search experiences that bypass traditional link-based results. These platforms don't just return links, they synthesize information, provide citations, and enable follow-up questions in ways that feel more natural and efficient.

Meanwhile, social media platforms like TikTok and Instagram have emerged as primary sources for product discovery and recommendations. Amazon has introduced Rufus, a generative AI shopping assistant that combines insights from its product catalogue with web information. These developments suggest that search is fragmenting across multiple specialized platforms rather than remaining centralized in a single dominant player.

The Economic Implications for Digital Marketing

This transformation creates profound challenges for businesses that have built their digital marketing strategies around Google's ecosystem. Companies that have invested heavily in search engine optimization (SEO), Google Ads, and content marketing designed to capture search traffic face a fundamental disruption to their customer acquisition models.

The shift toward AI-mediated search experiences means that traditional metrics like click-through rates, organic traffic, and search rankings may become less relevant. Instead, businesses will need to focus on how their content and brands are represented within AI-generated summaries and recommendations, a challenge that requires entirely new approaches to content strategy and brand positioning.

The AI-First Future: How AI Companies Will Dominate the Next Decade

The Infrastructure Layer: Building the Foundation of AI Dominance

The Coatue Fantastic 40 heavily emphasizes companies that provide the foundational infrastructure for the AI economy. NVIDIA's projected $5.6 trillion market cap reflects its position as the primary supplier of the computational power that drives AI development. The company's vision of "AI factories", gigawatt-scale data centres capable of supporting 100,000 GPUs or more, represents the physical infrastructure that will power the AI economy.

Microsoft's position at the top of the list ($5.7 trillion projected market cap) demonstrates how successfully integrating AI across an entire technology stack can create unprecedented value. The company's Azure cloud platform has become the backbone for countless AI implementations, with AI contributing 16 percentage points to Azure's 33% revenue growth in recent quarters. Microsoft's strategic partnership with OpenAI further solidifies its position at the centre of the AI ecosystem.

The Application Layer: AI-Native Business Models

OpenAI's remarkable trajectory illustrates the potential for AI-native companies to achieve extraordinary scale. The company projects revenue growth from $3.7 billion in 2023 to $174 billion by 2030, one of the fastest-scaling revenue curves in business history. This growth is driven not just by ChatGPT, which is expected to generate $8 billion in 2025, but by the emergence of AI agents and commercial services embedded across industries.

Anthropic, another AI-first company on the list, has demonstrated that focused AI development can achieve remarkable commercial success. The company hit $3 billion in annualized revenue by May 2025, up from approximately $1 billion in December 2024. This growth rate positions Anthropic as potentially the fastest-growing software-as-a-service company in history.

The Platform Integration Strategy

What distinguishes the most valuable AI companies is their ability to integrate AI capabilities across entire platforms rather than offering AI as an add-on feature. Meta's projected $2.8 trillion market cap reflects its successful integration of AI across its social media ecosystem, from content recommendation algorithms to AR/VR experiences. The company's recent acquisition spree, including its investment in Scale AI and attempts to acquire AI talent and companies, demonstrates the strategic importance of AI integration.

Tesla's inclusion in the list ($2.6 trillion projected) showcases how AI can transform traditional industries. The company's Full Self-Driving technology represents more than just autonomous vehicles, it's a comprehensive AI system that could eventually power robotaxi networks and reshape transportation economics.

The Competitive Moat of AI Companies

AI companies on the Fantastic 40 list possess several competitive advantages that traditional technology companies struggle to replicate:

Data Network Effects: These companies improve their services as more users provide data, creating self-reinforcing competitive advantages. Each interaction with ChatGPT makes the model better, and each Tesla mile driven improves the autonomous driving system.

Computational Scale: The massive computational requirements for training and running AI models create significant barriers to entry. Companies like OpenAI and Anthropic have invested billions in a computing infrastructure that competitors would struggle to replicate.

Talent Concentration: The limited pool of world-class AI researchers and engineers means that leading companies can attract and retain the best talent, further widening their competitive advantage.

The New Digital Business Fundamentals: Adapting to an AI-Mediated World

Reimagining Customer Discovery in the AI Era

The traditional digital marketing funnel, awareness, consideration, and conversion, are being fundamentally disrupted by AI-mediated discovery experiences. Businesses must now optimize for visibility and credibility within AI systems rather than just search engines. This requires a shift from keyword-based content strategies to creating authoritative, comprehensive information that AI systems can confidently reference and cite.

The rise of conversational AI means that businesses need to ensure their brand information is accurately represented when users ask AI assistants about products, services, or solutions. This requires a new form of "AI SEO" that focuses on providing clear, authoritative, and well-structured information that AI systems can easily parse and understand.

The Evolution of Content Strategy

Content marketing in the AI era must evolve beyond traditional blog posts and articles designed to rank in search results. Instead, businesses need to create content that serves as authoritative sources for AI training and reference. This includes:

Comprehensive Resource Creation: Rather than creating multiple thin pieces of content, businesses should focus on creating definitive, comprehensive resources that AI systems can confidently cite as authoritative sources.

Structured Data and Clear Attribution: Content must be structured in ways that make it easy for AI systems to extract and attribute information correctly, ensuring proper brand association when information is referenced.

Multi-Modal Content: As AI systems become more sophisticated in processing different types of content, businesses should invest in video, audio, and interactive content that provides rich information across multiple formats.

The New Economics of Digital Advertising

The shift toward AI-mediated experiences is fundamentally altering the economics of digital advertising. Traditional metrics like cost-per-click and click-through rates become less relevant when users increasingly receive answers directly from AI systems without clicking through to source websites.

Businesses must develop new frameworks for measuring the value of brand visibility within AI-generated responses and conversational interfaces. This might include tracking brand mentions in AI summaries, monitoring sentiment in AI-generated content about the brand, and measuring the quality of information AI systems provide about the company.

Platform Diversification Strategy

The fragmentation of discovery across multiple platforms, from TikTok and Instagram to AI chatbots and voice assistants, requires businesses to diversify their digital presence beyond Google-centric strategies. This includes:

Social Search Optimization: As younger demographics increasingly use TikTok and Instagram for product discovery, businesses must optimize their social media presence for search functionality within these platforms.

AI Platform Presence: Companies should actively engage with emerging AI platforms and ensure their information is accurately represented across different AI systems and chatbots.

Voice and Conversational Interfaces: As voice search and conversational AI become more prevalent, businesses must optimize for natural language queries and conversational discovery patterns.

Building AI-Proof Business Models

Perhaps most importantly, businesses must evaluate whether their core value propositions remain relevant in an AI-driven world. Companies that provide simple information aggregation or basic transactional services may find themselves disintermediated by AI systems that can perform these functions more efficiently.

The most resilient businesses in the AI era will be those that provide unique human value: creativity, empathy, complex problem-solving, and relationship-building that cannot be easily replicated by AI systems. Even these businesses, however, must ensure they remain discoverable and accessible as discovery patterns evolve.

The Call to Action: Preparing for the Post-Search Era

Immediate Strategic Imperatives

Digital businesses must act now to prepare for the fundamental changes ahead. The window for adaptation is narrowing as AI adoption accelerates and user behaviours shift more rapidly than many anticipated. The first imperative is conducting a comprehensive audit of current digital marketing dependencies, particularly the degree to which customer acquisition relies on Google search traffic and traditional SEO strategies.

Companies should immediately begin diversifying their discovery channels, investing in direct relationships with customers through email lists, social media communities, and brand experiences that don't depend on third-party platforms for customer access. This includes developing owned media properties and content hubs that can serve as authoritative sources for AI systems while building direct customer relationships.

Building AI-Native Marketing Capabilities

The transition to AI-mediated discovery requires developing entirely new marketing capabilities. Marketing teams must become proficient in AI tools and platforms, understanding how to optimize content for AI consumption and citation. This includes learning to create content that serves both human readers and AI systems, ensuring proper attribution and brand association in AI-generated summaries.

Companies should invest in data infrastructure that allows them to track and measure their presence across AI platforms and conversational interfaces. This requires developing new metrics and key performance indicators that reflect value creation in an AI-mediated world, moving beyond traditional web analytics to understand brand representation in AI-generated content.

Long-Term Strategic Positioning

The most successful companies in the post-search era will be those that become essential partners in AI-driven ecosystems rather than passive participants hoping for discovery. This means creating products, services, and content that AI systems actively seek out and reference, positioning the company as an authoritative source in its domain.

Businesses should consider how they can contribute to the AI ecosystem rather than just compete for attention within it. This might include developing APIs that AI systems can access, creating datasets that improve AI capabilities, or building complementary services that enhance AI-driven user experiences.

The digital marketing revolution triggered by AI represents both the greatest challenge and the greatest opportunity for businesses in decades. Companies that recognize the magnitude of this shift and act decisively to adapt their strategies will emerge as leaders in the new economy. Those who cling to traditional approaches risk becoming invisible in a world where discovery, engagement, and value creation follow entirely new rules.

The absence of Google from the Coatue Fantastic 40 should serve as a wake-up call for every digital business: even the most dominant platforms are vulnerable to disruption when fundamental paradigms shift. The companies that will thrive in 2030 are those that start building for that future today, recognizing that the fundamentals of digital business are not just evolving, they are being completely reimagined.